Peloton’s partnership with TrueMed, a healthcare reimbursement company, may allow for HSA and FSA reimbursement to cover Peloton expenses. Keep reading below the fold to learn more.

For those with a Health Savings Account (HSA) or Flexible Spending Account (FSA), you may be able to use them to cover the expenses of Peloton equipment.

According to Pelo Buddy:

This partnership aims to streamline the process of using HSAs and FSAs to cover Peloton expenses, potentially opening doors for customers to invest in their well-being at a lower cost. This lower cost comes from the fact that the money you put towards an HSA or FSA is generally made before taxes are deducted.

For its part, Peloton emailed some people advertising the partnership:

We believe movement should be accessible to everyone. You may be able to use your pre-tax flexible spending (FSA) or health savings account (HSA) funds toward Peloton products by working with a third party such as Truemed. Find out if you’re eligible.

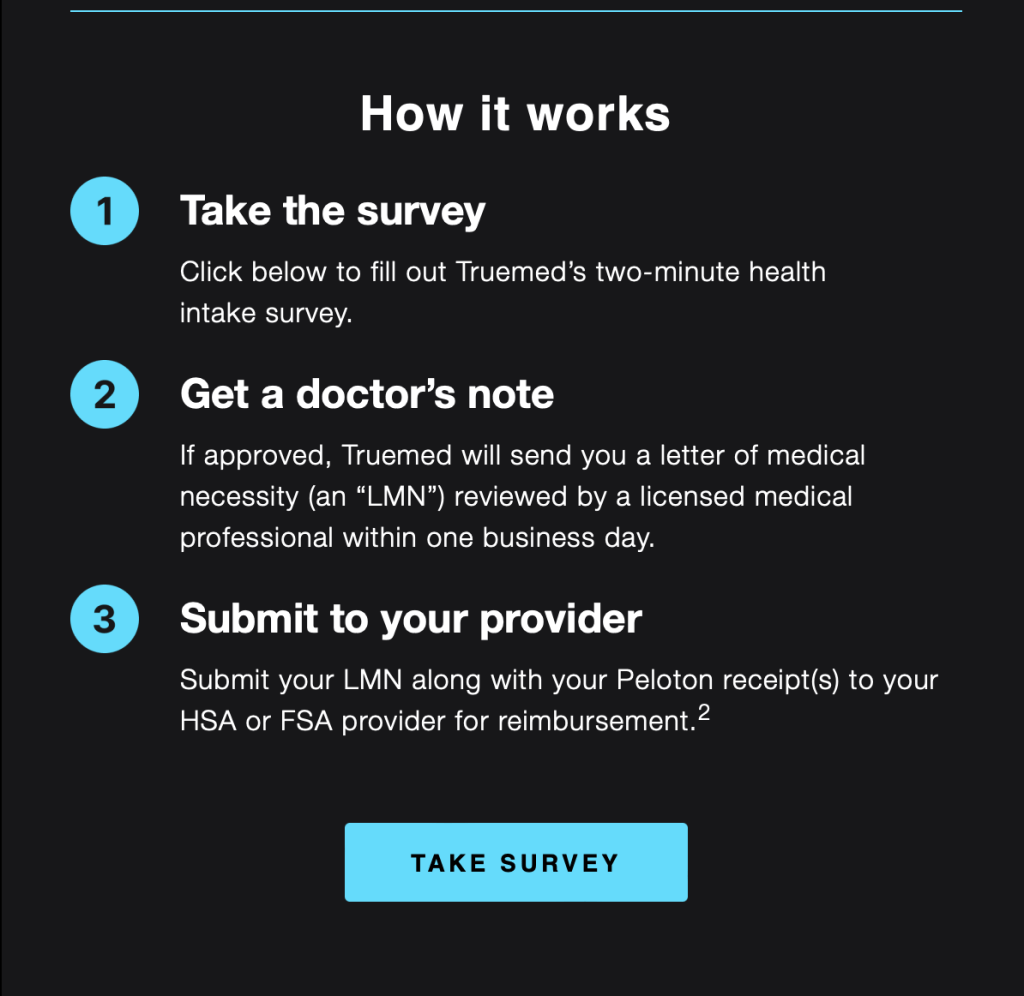

In order to find out your eligibility, the email provided a link for customers to determine whether or not they qualify to use HSA/FSA funds toward a Peloton purchase.

Once someone qualifies, they will receive information from TrueMed that will help to facilitate their HSA/FSA provider submissions, ensuring that proper documentation has been used to demonstrate that a Peloton purchase does, in fact, qualify for reimbursement under a health care plan.

For those wanting to see if they may be able to purchase a Peloton device with the aid of HSA/FSA funds, click here for the TrueMed survey.

More on Peloton:

- NBA star Mikal Bridges will ride live with Peloton instructor Jess Sims

- Tunde Oyenin, Peloton instructor, tapped to speak at IAMPHENOM

- Andy Speer to attend Day of Wellness in Tampa Bay

FTC: We use income earning auto affiliate links. More.