Under the new leadership of Barry McCarthy, Peloton has dramatically shifted its strategy as a company. Peloton cutting costs this year by eliminating most manufacturing and letting go of a huge percentage of their workforce is what is most noticeable. However, there is seemingly a lot more to Peloton’s new strategy. Here is why it might actually work.

Outside of cost cutting, it seems that Peloton has adopted three new strategies this year:

- New pricing models

- New content structure

- New digital app strategy

I’ll try to summarize each of these below, but if you want to get the more in-depth analysis of how Peloton is changing, you can watch the full video on it here:

Subscribe to Connect The Watts for more connected fitness news, updates, tips, and guides

New pricing model

Peloton’s primary source of profit up until now has been its membership subscription. While the Peloton Tread and Guide may have driven some new memberships, they are much more likely to be bought by someone who is already a Peloton member.

When a Peloton Tread is bought by a current Peloton member, no new subscription revenue is generated. It seems that Peloton is finally reacting to this with a change in its pricing model.

First by lowering the cost of the original Peloton Bike. If these are the drivers for Peloton’s membership growth, making them as easily available as possible makes sense.

Second, by raising the cost of all other equipment. If Peloton sees little additional membership growth from other devices like the Peloton Tread and Row, then it makes sense to sell them at a premium.

Not only does this help Peloton make a profit on their equipment, but they also have the advantage of doing so over other companies. Sure, you can save money on a rower from a company like Hydrow… but if you are already a Peloton Member, that means you will have to pay for an additional membership. So while Peloton is more expensive upfront, the price difference ends up being a wash after a year or two.

This is why if Peloton ever releases a Tonal competitor, I think it is safe to assume it will be priced around $600-$1,000 more than Tonal. With the Tonal Membership costing over $500 per year, Peloton is betting that you’d pay the premium upfront to stick with them.

New content strategy

Peloton is slowly changing the way they create and release content. The most important change is exclusivity: They tested the waters with time-exclusive content for the Peloton Guide.

With this release, they changed how new strength programs were delivered, making these new programs exclusive to the Guide for seven weeks before being released to all other members.

Now they are doubling down.

With the release of the Peloton Row, they have decided to make the content permanently exclusive. So the only way to access rowing content is by owning a Peloton Row, thus taking away much of the incentive for Peloton members to buy a rower like the Concept 2 (which costs over $2,000 less).

New digital app strategy

Peloton may not have said it yet, but their actions make it clear that they want the Peloton app to compete with Strava.

Recently, Peloton has changed the app so that you can:

- Track all of your workouts (including outdoor runs) even when not taking a Peloton class.

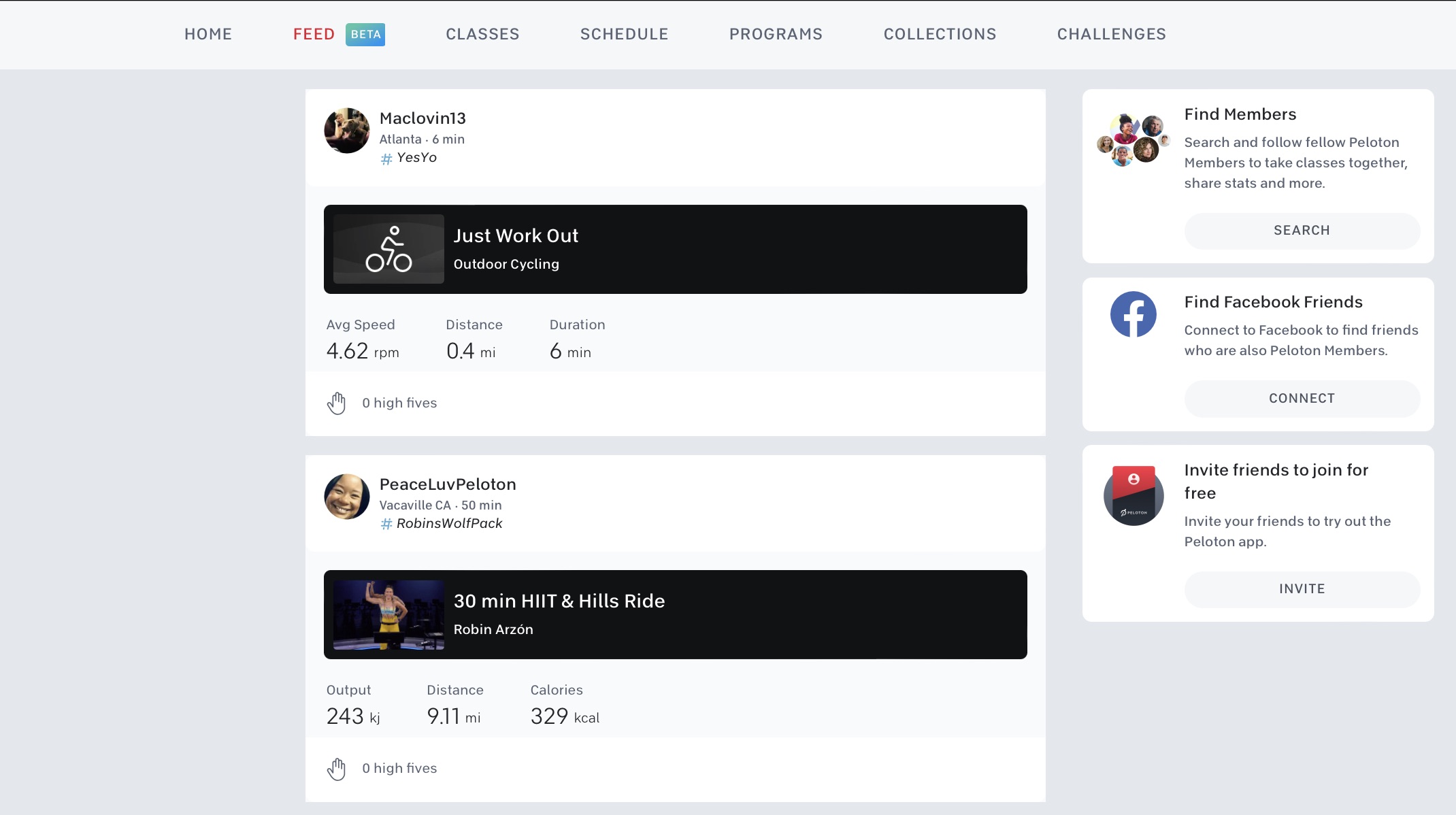

- Interact with a newsfeed where you can like and comment on your friend’s workouts (still in beta).

If they make their app free (which they have said they plan on doing) and add routes and heat maps (like Strava), it could actually work as a compelling alternative – not only as a workout tracker but also as a fitness social media platform, with the additional capability of providing some of the best workout content currently made.

Though Strava has a much larger user base of over 100 million, Peloton still has a pretty big advantage when it comes to paying subscribers. With a freemium version of their app that includes social newsfeeds, this could be Peloton’s smartest way to drive growth long term.

Peloton has had a rough past few years, but they still have a huge advantage as the most popular brand in connected fitness. These new strategies may be enough to help keep them there.

Suggested articles:

- 15 Peloton accessories that are actually amazing

- Peloton executives, including John Foley, sued for insider trading

- Speediance review: Better value than Tonal?

FTC: We use income earning auto affiliate links. More.